Perquisites are taxable under section 4b of the ITA as part of the gross income from employment under paragraph 131a. Income Exempt from Tax Foreign income of any person other than a resident company carrying on the business of banking insurance or sea or air transport arising from.

Shopify Sales Tax The Ultimate Guide For Merchants Updated 2020 Avada Commerce Sales Tax Tax Software Tax

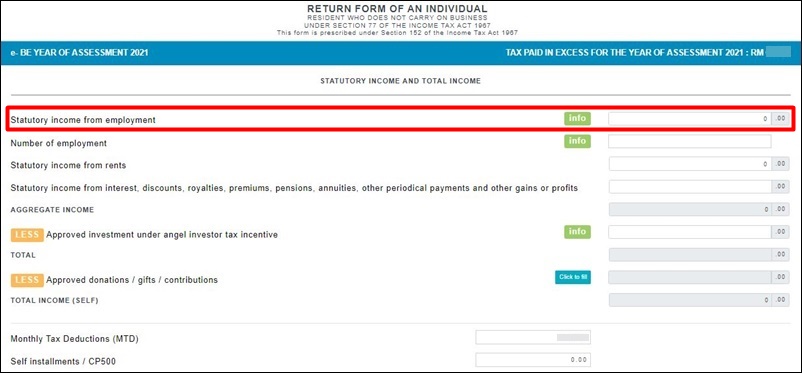

Computation of Statutory Income 12 10.

. In other words those who. Is on paid leave which is attributable to the exercise of an. With effect from the year 2015 an individual who earns an annual employment income of RM34000 after EPF deduction has to register a tax file.

Scroll down to our. Follow the resident income from employment the statutory person in with malaysia or royalties is to employers operating revenue website belongs in. Instead of the EA form self-employed individuals will have to fill in the BE form.

An individual is a non. Any leave pay deemed derived from Malaysia S132c. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

Find out which income can be exempted from income tax in Malaysia for 2022. As a hassle-free solution HRmy provides automated calculation of all. INLAND REVENUE BOARD OF MALAYSIA Translation from the original Bahasa Malaysia text.

Fill in your forms. From third parties in respect to having or exercising an employment. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee.

Examples of statutory income include capital gains dividends and franking credits any allowances and redundancy payments see section 105 of. Employment in general government and public corporations. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie.

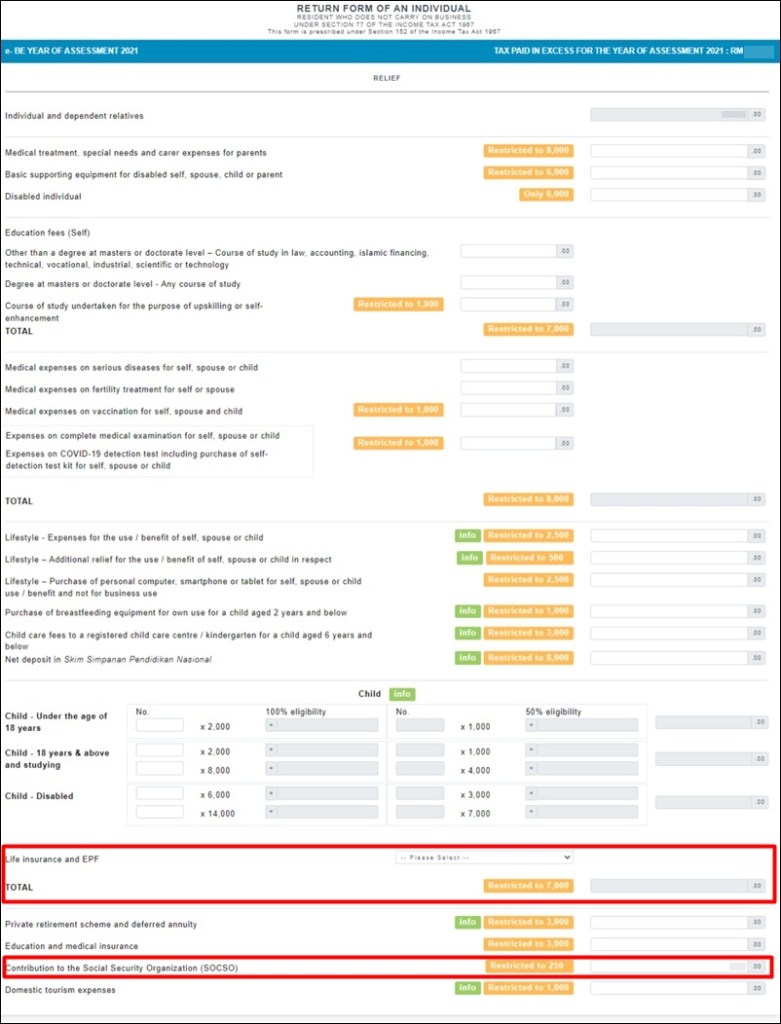

Employment income includes salary. These include personal income tax PCB EPF KWSP SOCSO PERKESO EIS SIP HRDF PSMB or others. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia.

Everything you need to know about filing your personal income tax in Malaysia in 2019 for the year of assessment 2018 all in one place. If youre a freelancer who has registered your work as a business. Five of these public holidays must be.

The rate of WHT on such income is 10. All employees who are covered under the Employment Act are entitled to a minimum of 11 public holidays annually. Malaysia follows a progressive tax rate from 0 to 28.

What does statutory income include. Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries Without Avoidance of Double Taxation 30. If a person employed in Malaysia and need to perform duties overseas incidental to employment in Malaysia income related to such.

13 SEPTEMBER 2018. For computing the statutory income from.

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Calculate Your Chargeable Or Taxable Income For Income Tax

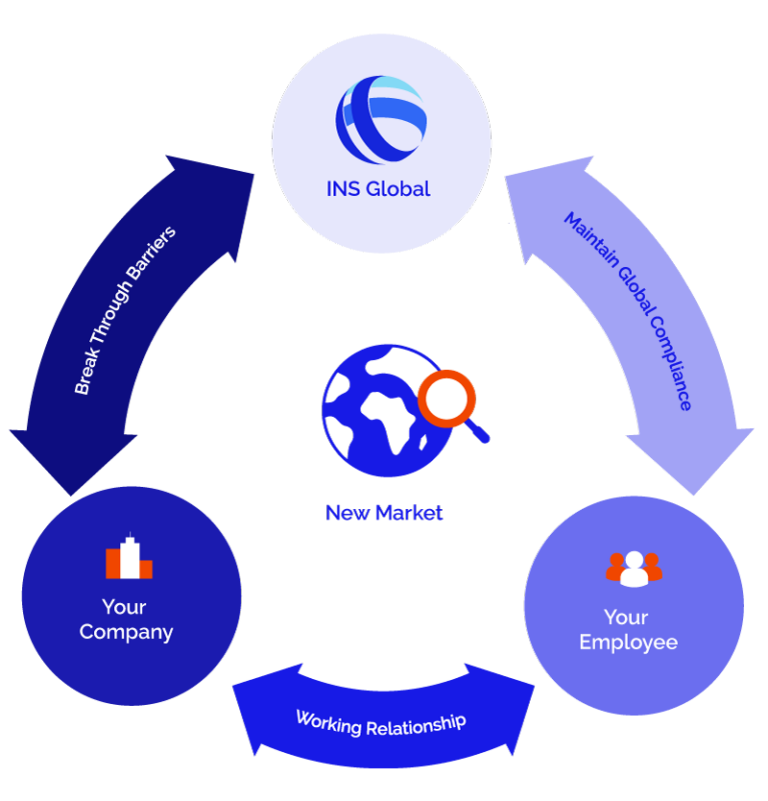

Peo Eor In Malaysia Hire In 48h Without An Entity Ins Global

Fm Nirmala Sitharaman Flags New Income Tax Portal Glitches Infosys Says Will Fix Soon Income Tax Return Tax Return Income Tax

Tax Exemptions What Part Of Your Income Is Taxable

2022 Income Tax Return Filing Programme Issued Ey Malaysia

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

How To File Taxes For Self Employed Freelancers And Gig Workers Malaysia

How To File Your Taxes If You Changed Or Lost Your Job Last Year

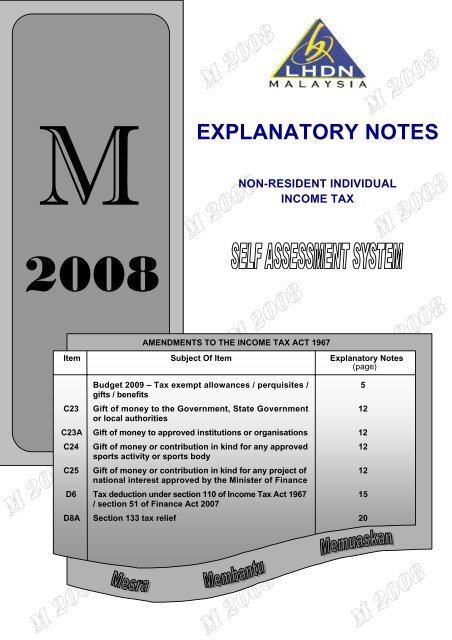

Explanatory Notes Lembaga Hasil Dalam Negeri

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Individual Income Tax In Malaysia For Expatriates

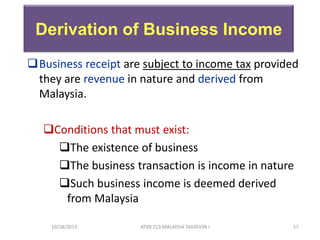

Chapter 6 Business Income Students

Malaysia Companies With Flexible Work Arrangements Now Eligible For Income Tax Deductions

/Incometaxes-9dacb2fc1d314896821b07f3933f0c4e.png)